“The Worst for the Markets in the US is Not Over Yet” Jeffrey Gundlach on Coronavirus

The sell-off in the markets is rising and they will continue due to the coronavirus pandemic before the market hits the rock bottom, which will be more “enduring” bottom than the one in March, as per the DoubleLine CEO Jeffrey Gundlach.

“The low we hit in the middle of March … I would bet that low will get taken out,” Gundlach said on Tuesday. “The market has really made it back to a resistance zone and the market continues to act somewhat dysfunctionally in my opinion. … Take out the low of March and then we’ll get a more enduring low.”

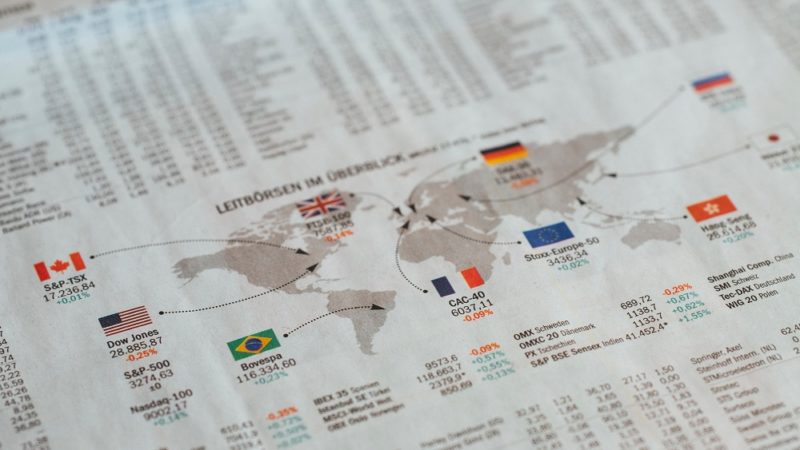

The benchmark index S&P 500 stumbled heavily and reflected a stronger bear market due to the rising panic among the investors due to the potential recession that is expected as a result of coronavirus pandemic. Last week the S&P 500, closed at a three-year bottom at 2,237.40.

Although after the historic lows the markets did seem to pick up and reflected a three-day rally which was the best one since the late 1930s. The said tally made the investors wonder whether the worst is over yet but such expectation took a blunder when the market fell again this Tuesday.

Some experts are anticipating the US economy will see a “V” shaped recovery, in the form of a blunder in the first and second quarters and sharp uprising in the third. Gundlach rubbished these talks as “highly, highly optimistic, “and these forecasts that do not consider the magnitude of GDP losses for the coming year are “outrageously improbable.”.

Earlier in March, Gundlach predicted a horrible position for the US economy for the year and also predicted that there are 9 out of 10 chances that the US will enter into a recession due to the coronavirus pandemic. At since that time the virus’ cases have only been going up signaling toward an even worst position.

The US has now exceeded the number of infected people due to the coronavirus pandemic from China or any other country.