Pros & Cons Associated with a Capable U.S. Dollar

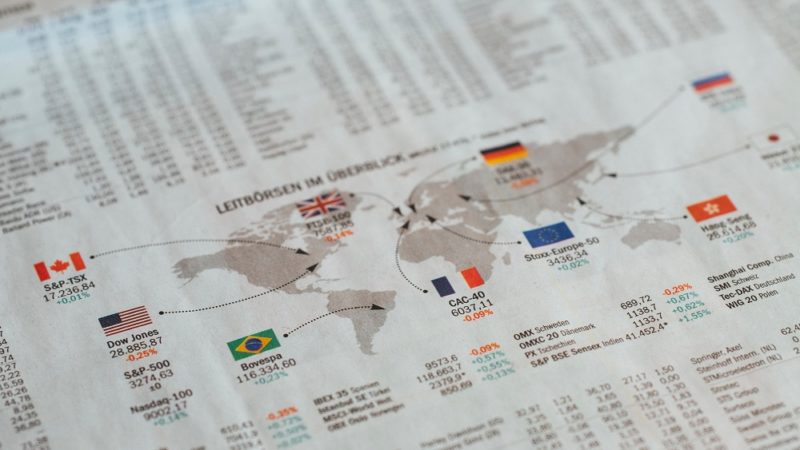

The power and capability of the U.S. dollar have increased because it’s a currency that has come out of excessive recession and raised again. The PowerShares DB U.S. Dollar Index ETF (UUP) indicates the value of a dollar in comparison to its exchange rate against other foreign currencies i.e., the Euro, British Pound, Swedish Krona, Japanese Yen, Canadian Dollar, and Swiss Franc; which consistently been showing a hiking year by year.

A capable U.S. dollar is profitable for some and equally unfavourable for others. The following are some pros and cons associated with a strong U.S. dollar.

Pros

- For the U.S. dollar owners, travelling in foreign countries is comparatively less expensive. Americans users of U.S. dollars can see those dollars heading towards foreign countries, which provide these users considerable buying power over other countries. A strong dollar can purchase major possibilities after being converted into local currency.

- Importing is measurably cheaper in the United States. Goods and materials which are made in foreign countries and then imported to the U.S. are considered to be less expensive when the producer’s currency value drops in comparison to the U.S. dollar. These cheaper imports allow American users to earn and save more money. That’s why most of the American companies prefer to import raw components in order to lower manufacturing costs and amplify profit amount.

- Companies abroad which perform major business in the United States, keep its investors profited. Many Multinational companies that make heavy sales in the U.S. earn benefit in the form of dollars. Thus, these companies earn a large profit margin when the dollars are converted into other currencies’ and income recorded in balance sheets.

Cons

- Visiting the United States is very expensive for foreign tourists. The reason is the foreign visitors find services as well as materials’ prices extremely high. Visitors who’re being paid in their home currency and then come to visit the U.S. by converting that into U.S. currency’s denomination, bear a very travelling cost.

- Exporters that deal with the United States are in pain most of the time. Importing is cheaper because the value of the U.S. dollar is more than other currencies; on the contrary, importing goods or services from the U.S. (exported by the U.S.) is very expensive for other countries.

- Investors of the U.S./domestic companies that perform major businesses in other countries face hardships. Multinational companies in the U.S. that make its most of the dealings in foreign countries get hurt because their earnings will drop after being converted into U.S. denomination.